1. 银行业的数字化转型

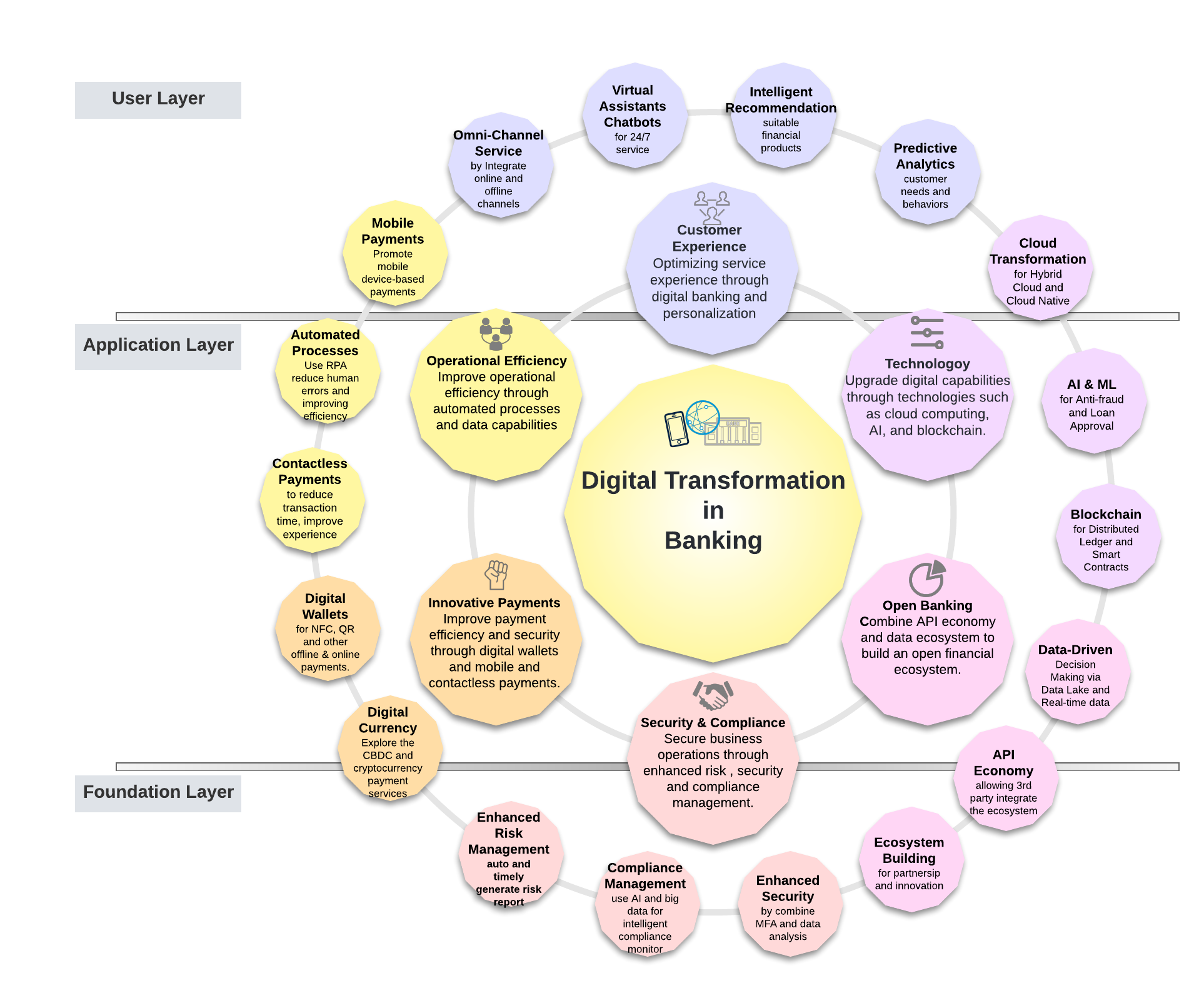

银行和支付行业的数字化与智能化转型是一个多层次、多维度的变革过程,涉及技术、运营、客户体验和合规等方面。以下是更具体和深入的讨论:

1.1 客户体验优化

• 全渠道服务:整合线上和线下渠道,提供一致且无缝的客户体验。例如,客户可以在线申请贷款,并在离线网点进行面对面的面试。

• 虚拟助手和聊天机器人:使用自然语言处理技术提供24/7智能客户服务,回答常见问题并处理账户查询。

• 智能推荐系统:根据客户的交易历史、行为数据和财务状况,智能推荐适合的金融产品,如信用卡、贷款方案和投资产品。

• 预测分析:使用机器学习模型预测客户需求和行为,例如提前识别潜在的逾期贷款风险并采取相应的预防措施。

1.2 技术升级

• 云转型:结合私有云和公有云的优势,以满足不同的业务和安全需求。核心系统和敏感数据存储在私有云中,而非核心系统和数据则部署在公有云中,以提高灵活性和可扩展性。采用微服务架构和容器技术开发和部署云原生应用,提高系统的可维护性和可扩展性。

• 人工智能和机器学习:使用机器学习算法实时监控交易行为,检测和防止可疑交易。例如,分析交易模式以识别异常的大额转账或频繁的小额交易。利用人工智能进行信用评分和风险评估,自动化审批流程,提高审批速度和准确性。

• 区块链技术:在跨境支付和清算中应用分布式账本技术,减少中介、降低交易成本,并提高透明度和安全性。使用智能合约自动执行合同条款,简化保险索赔和供应链融资等复杂的金融交易流程。

• 数据驱动决策:构建统一的数据湖和数据仓库平台,集中存储和管理各种类型的企业数据,支持多维数据分析和挖掘。引入实时数据流处理技术,及时分析客户行为和市场变化,快速响应业务需求和风险事件。

1.3 开放银行

• API经济:开发和提供标准化的API接口,允许第三方开发者访问银行数据和功能,促进金融创新和生态系统建设。在共享数据时确保数据隐私和安全,采用数据加密和访问控制等措施保护客户信息。

• 生态系统建设:与金融科技公司、支付服务提供商和其他金融机构建立战略合作关系,共同开发创新的金融产品和服务。

1.4 安全与合规

• 强化安全措施:结合生物识别、短信验证码和硬件令牌等多种身份验证方式,提高账户安全性。利用人工智能分析用户行为,检测异常活动,防止账户盗窃和数据泄露。

• 合规管理:利用人工智能和大数据技术自动监测和评估业务流程的合规性,及时识别和处理合规风险。

• 强化风险管理:自动监控、生成和提交风险报告,确保及时和准确的风险分析满足要求。

1.5 创新支付方式

• 数字货币:探索和试点中央银行数字货币的应用,提高金融系统的效率和透明度,支持数字经济的发展。

• 数字钱包:推出银行自有的数字钱包应用,支持NFC、二维码等支付方式,方便客户进行线下和线上支付。

• 无接触支付:升级商户POS终端,支持无接触和移动支付,减少交易时间,提高客户体验。改造ATM机,支持二维码取款和无卡取款,增强客户服务能力。

• 加密货币支付:为客户提供加密货币支付和交易服务,以满足多样化的金融需求。

1.6 运营效率提升

• 流程自动化:使用RPA技术自动化重复性、高频率的业务流程,如客户入驻、报告生成和合规检查,减少人为错误,提高效率。

• 移动支付:推广基于移动设备的支付方式,如Apple Pay、Google Pay、微信支付和支付宝,以提升支付便利性和安全性。

2. 银行业数字化转型成熟度评估

评估银行业的数字化转型成熟度涉及评估各种模型和关键指标。德勤的数字成熟度模型和普华永道的数字智商模型提供了在战略、创新、客户体验、运营和技术等维度上评估数字成熟度的框架。与客户体验、运营效率、技术能力、创新和敏捷性相关的关键指标在评估银行数字化转型的有效性中起着至关重要的作用。这些指标帮助银行识别优势和改进领域,使其能够做出明智的决策,以增强数字能力,更好地应对数字时代的挑战和机遇。

2.1 关键评估指标

2.1.1 数字战略

• 数字愿景

o 清晰的数字战略:具备清晰的数字愿景和战略。

o 战略对齐:数字战略与整体商业战略的对齐。

• 领导力与治理

o 领导支持:高层管理对数字化转型的支持和参与。

o 治理结构:有效的治理结构和数字化转型管理流程。

2.1.2 数字能力

• 客户体验优化

• 技术升级

• 运营效率提升

• 安全与合规

• 开放银行

• 创新支付方式

• 区块链和加密货币

2.2 成熟度评分卡

每个维度可以根据以下成熟度等级进行评估:

• 新手(1-2):刚开始探索,成熟解决方案很少。

• 发展中(3-4):有一些实施,但未完全部署或集成。

• 高级(5-6):大部分领域已数字化,产生了显著效果。

• 成熟(7-8):全面数字化,所有领域高度集成,数字战略推动业务创新。

示例评分卡

| 维度 | 成熟度评分 | 描述 |

| 数字战略 | 6 | 清晰的数字战略,与业务高度对齐 |

| 客户体验 | 5 | 部分渠道集成,虚拟助手和推荐系统有效 |

| 技术升级 | 4 | 广泛使用云计算和人工智能,区块链技术处于早期阶段 |

| 运营效率 | 5 | 高应用自动化流程和数据驱动决策 |

| 安全与合规 | 6 | 广泛使用多因素认证和行为分析 |

| 开放银行 | 3 | 初步构建开放API平台,生态系统建设处于探索阶段 |

| 创新支付方式 | 5 | 数字钱包和无接触支付的高渗透率 |

| 区块链和加密货币 | 3 | 一些跨境支付使用区块链,智能合约和加密货币支付处于早期阶段 |

该框架不仅帮助银行评估其当前数字化转型状态,还提供了在关键领域进展的路线图。

==========

1. Digital Transformation in Banking

The digitalization and intelligence transformation of the banking and payment industry is a multi-level, multi-dimensional process of change, involving aspects such as technology, operations, customer experience, and compliance. The following is a more specific and in-depth discussion:

1.1 Customer Experience Optimization

- Omni-channel Services: Integrate online and offline channels to provide a consistent and seamless customer experience. For example, customers can apply for loans online and conduct face-to-face interviews at offline branches.

- Virtual Assistants and Chatbots: Use natural language processing technology to provide 24/7 intelligent customer service, answering common questions and handling account inquiries.

- Intelligent Recommendation Systems: Based on customers’ transaction history, behavior data, and financial status, intelligently recommend suitable financial products such as credit cards, loan schemes, and investment products.

- Predictive Analytics: Use machine learning models to predict customer needs and behaviors, such as identifying potential overdue loan risks in advance and taking corresponding preventive measures.

1.2 Technological Upgrades

- Cloud Transformation: Combine the advantages of private and public clouds to meet different business and security needs. Core systems and sensitive data are stored in private clouds, while non-core systems and data are deployed in public clouds to improve flexibility and scalability. Develop and deploy cloud-native applications using microservices architecture and container technology to improve system maintainability and scalability.

- Artificial Intelligence and Machine Learning: Monitor transaction behavior in real-time using machine learning algorithms to detect and prevent suspicious transactions. For example, analyze transaction patterns to identify abnormal large transfers or frequent small transactions. Use AI for credit scoring and risk assessment, automate approval processes, and improve approval speed and accuracy.

- Blockchain Technology: Apply distributed ledger technology in cross-border payments and clearing to reduce intermediaries, lower transaction costs, and increase transparency and security. Use smart contracts to automatically execute contract terms, simplifying complex financial transaction processes such as insurance claims and supply chain financing.

- Data-Driven Decision Making: Build a unified data lake and data warehouse platform to centrally store and manage various types of enterprise data, supporting multidimensional data analysis and mining. Introduce real-time data stream processing technology to analyze customer behavior and market changes in a timely manner, and respond quickly to business needs and risk events.

1.3 Open Banking

- API Economy:Develop and provide standardized API interfaces, allowing third-party developers to access bank data and functions, promoting financial innovation and ecosystem construction. Ensure data privacy and security while sharing data, using measures such as data encryption and access control to protect customer information.

- Ecosystem Building Establish strategic partnerships with fintech companies, payment service providers, and other financial institutions to jointly develop innovative financial products and services.

1.4 Security and Compliance

- Enhanced Security Measures: Combine various authentication methods such as biometrics, SMS verification codes, and hardware tokens to enhance account security. Use AI to analyze user behavior, detect abnormal activities, and prevent account theft and data leaks.

- Compliance Management: Use AI and big data technology to automatically monitor and assess the compliance of business processes, timely identify and deal with compliance risks.

- Ehanced Risk Management: Automatically monitor and generate and submit risk reports to ensure timely and accurate risk analysis with requirements.

1.5 Innovative Payment Methods

- Digital Currency:Explore and pilot the application of central bank digital currencies to improve the efficiency and transparency of the financial system and support the development of the digital economy.

- Digital Wallets: Launch bank-owned digital wallet applications that support NFC, QR codes, and other payment methods, making it convenient for customers to make offline and online payments.

- Contactless Payments: Upgrade merchant POS terminals to support contactless and mobile payments, reduce transaction time, and improve customer experience. Transform ATM machines to support QR code withdrawals and cardless withdrawals, enhancing customer service capabilities.

- Cryptocurrency Payments: Provide customers with cryptocurrency payment and trading services to meet diverse financial needs.

1.6 Operational Efficiency Improvement

- Process Automation: Use RPA technology to automate repetitive, high-frequency business processes such as customer onboarding, report generation, and compliance checks, reducing human errors and improving efficiency.

- Mobile Payments: Promote mobile device-based payment methods such as Apple Pay, Google Pay, WeChat Pay, and Alipay to enhance payment convenience and security.

2. Digital Transformation Maturity Assessment in Banking

Assessing the digital transformation maturity of the banking industry involves evaluating various models and key indicators. Models like Deloitte’s Digital Maturity Model and PwC’s Digital IQ Model provide frameworks to assess digital maturity across dimensions such as strategy, innovation, customer experience, operations, and technology. Key metrics related to customer experience, operational efficiency, technology capability, and innovation and agility play a crucial role in evaluating the effectiveness of digital transformation in banking. These metrics help banks identify strengths and areas for improvement, enabling them to make informed decisions to enhance their digital capabilities and better prepare for the challenges and opportunities of the digital age.

2.1 Key assessment indicators

2.1.1. Digital Strategy

- Digital Vision

-

- Clear Digital Strategy: Presence of a clear digital vision and strategy.

- Strategic Alignment: Alignment of digital strategy with overall business strategy.

- Leadership and Governance

-

- Leadership Support: Support and involvement of top management in digital transformation.

- Governance Structure: Effective governance structure and management processes for digital transformation.

2.1.2. Digital Capability

- Customer Experience Optimization

- Technology Upgrade

- Operational Efficiency Enhancement

- Security and Compliance

- Open Banking

- Innovative Payment Methods

- Blockchain and Cryptocurrency

2.2 Maturity Scorecard

Each dimension can be assessed according to the following maturity scale:

- Novice (1-2): Just beginning exploration, with few mature solutions.

- Developing (3-4): Some implementation, but not fully deployed or integrated.

- Advanced (5-6): Most areas are digitalized, with significant effects.

- Mature (7-8): Fully digitalized, with high integration in all areas, and digital strategy driving business innovation.

Example Scorecard:

| Dimension | Maturity Score | Description |

| Digital Strategy | 6 | Clear digital strategy, highly aligned with business |

| Customer Experience | 5 | Partial channel integration, effective virtual assistants and recommendation systems |

| Technology Upgrade | 4 | Widespread use of cloud computing and AI, blockchain technology in early stages |

| Operational Efficiency | 5 | High application of automated processes and data-driven decision-making |

| Security and Compliance | 6 | Wide use of multi-factor authentication and behavioral analysis |

| Open Banking | 3 | Initial construction of open API platform, ecosystem building in exploration stage |

| Innovative Payment Methods | 5 | High penetration of digital wallets and contactless payments |

| Blockchain and Cryptocurrency | 3 | Some cross-border payments using blockchain, smart contract and cryptocurrency payments in early stages |

This framework not only helps bank companies assess their current state of digital transformation but also provides a roadmap for progress in key areas.